Trump’s 200% Tariffs on Pharmaceuticals

- kirstyaldous

- Jul 8

- 3 min read

Updated: Sep 29

Pharmaceuticals took centre stage yesterday as Donald Trump announced possible 200% tariffs on pharmaceutical imports to the United States. In 2024, the US imported $212B of pharmaceutical products, making them the 5th most imported product in the US (OEC, 2025). Alongside Make America Healthy Again (MAHA) and Trump’s overarching economic policies, Trump’s proposition to dramatically increase tariffs on foreign drugs further intertwines economic nationalism, public health, and domestic manufacturing.

At Polecat, we track how these debates are playing out in the public domain. What’s striking right now is the gap between what’s grabbing headlines (tariffs, trade wars, politics) and what’s really worrying people (access, affordability, chronic shortages).

On the surface, it’s a powerful move that repackages the classic American Dream of national strength and prosperity, with a focus on both industrial revival and healthcare security. US companies, including Eli Lily, have already addressed actions to extend their presence at home. However, this is occurring alongside scepticism over tariffs from company executives, who are voicing fears over the risks posed to investments in biotech and innovation. Supply chain interruptions caused by the imposition of tariffs are sparking serious concerns about drug affordability and patient welfare as many of the critical drugs American people rely on are made overseas. Moreover, the recent boom in GLP-1 drugs exists as part of a growing model of preventative and outcome-driven healthcare in the US, but with many active ingredients being manufactured in Ireland, the proposed tariffs threaten to undermine the healthcare innovation this same government have been promoting.

Public Perception

One of the clearest patterns we see in the discourse is a growing public demand for pharmaceutical resilience. People want to know that their medicines will be available when they need them and to trust they will not to face shortages. Alongside this, we are seeing a stark decline in sentiment regarding US nationalism. What we’re seeing in the public domain is a misalignment between perception and reality.

Resilience requires infrastructure, investment, and time. Tariffs may provide temporary leverage and incentives, but they also risk short-term disruption, higher drug costs, and reduced availability. A short time frame does not mitigate impact in relation to healthcare and public welfare. The idealised conception of tariffs as the singular unit that can reshore the pharmaceutical industry, even given ‘a year, year and half’ (Trump, Financial Times), is out of sync with operational realities.

The tension between patriotic rhetoric and practical consequence is promoting a fragmentation in discourse. At Polecat, we help organisations cut through the noise by showing which issues are cutting through and what that means for stakeholder action, market confidence or policy direction. We analyse public discourse at scale, not just what is being said, but how it is being said.

Market Scepticism

Interestingly, this incredulity isn’t limited to patients and advocates. Investors are also demonstrating scepticism over Trump’s words. Indeed, rather than entering red, many biotech and pharmaceutical companies closed in the green yesterday. This is not a sign of confidence in policy - it is a signal that the market no longer believes in Trump’s announcements, with investors betting that this is theatre rather than policy. This is the kind of insight Polecat helps surface - sentiment patterns that expose when political messaging loses traction with key audiences.

The data suggests we’re operating in a trust deficit with credible signals being increasingly hard to recognise. With investors seeing this as a headline without a plan, it seems unlikely the tariff will promote the kind of long-term investments it is meant to encourage. The turn to pharmaceuticals means that this is directly tied to possible lessening of investment into citizen health and welfare, particularly on a short term scale, whether the tariff is enforced or not.

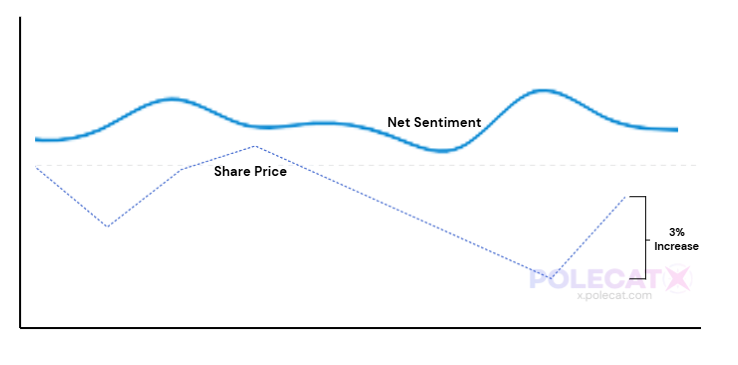

Polecat lets you map public opinion alongside stock performance, giving you critical insight into how geopolitical shifts impact your business. We don’t just track what policymakers say, but how stakeholders - including investors, executives, clinicians, and the public - respond. This helps clients not just follow the news cycle, but potentially gain early indicators of stock price movement.

Comments